FinTech start-up troy is transforming debt collection

Text: Susanne Weller I Photos: Troy

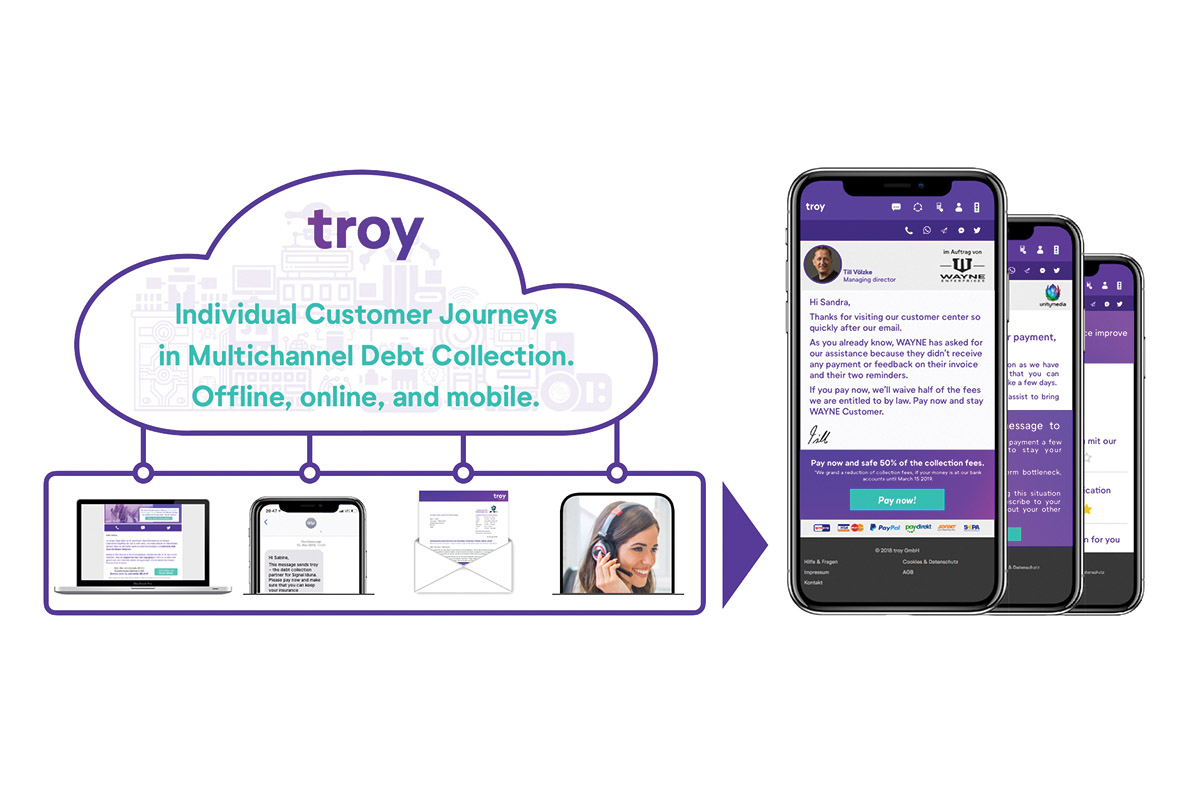

In the sector of financial services, the benefits of digitisation and customer experience are still widely untapped. This is to the disadvantage of both customers and companies. Now, German FinTech start-up troy takes on the industry by bringing debt collection into the age of customer friendly experience. Why and how do they do it?

In 2017, troy was founded by Philip Rürup and Till Völzke with the mission to initiate and establish customer experience in debt collection whilst fulfilling the two key aims to recover debt successfully and, at the same time, preserve the customer relationship. The founders bring together more than 20 years of experience in debt collection and are convinced that their solutions tackle a huge problem. Philip Rürup explains: “Studies show that about half of the people default on payments due to forgetfulness or short-term bottlenecks. Despite that, debt collectors address all customers as if they had intentionally not paid the claim, with a bureaucratic tone that sometimes even feels threatening. This ends customer relationships for good. We at troy focus on improving the debt collection experience, and we prove that this even leads to significantly more and faster payments.”

Philip Rürup, one of the two founders of troy.

troy provides the same services as traditional debt collectors but uses a tech-first approach to incorporate tools and methods from customer relationship management as well as machine learning to improve services and experiences. “For clients, it is best practice to continually benchmark two or more debt collection agencies and compare their recovery rates. Over the years, the performance of professional debt collection agencies was quite equal. With the ‘troy experience’, we take debt collection to a new level and have beat every benchmark since our launch by far. While the core process and its phases are still comparable to traditional approaches, we redesigned nearly every aspect of it, ranging from data-driven individualisation over multichannel interactions to real-time transparency. Customers and clients alike appreciate this, customers by paying faster, and clients by entrusting us higher volumes,” says Philip Rürup.

Based on the strong growth in Germany and backed with additional funding by existing and new investors, troy is now pushing for internationalisation, starting in the Netherlands. Philip Rürup: “Our clients, mainly international Corporations, have asked us to provide the same level of debt collection experience across the EU to help them stay in control of their brand. They said that they would even be willing to accept lower recovery rates. But we will make sure they don’t have to choose one over the other and deliver on both ends. We are deeply convinced that a respectful attitude and customer-focused communication in real-time will support our clients to achieve sustainable and long-lasting customer relationships.”

troy management board.

Subscribe to Our Newsletter

Receive our monthly newsletter by email